The Small Businessperson Of The Year Award Qualifications Overview Are Focused On:

Entrepreneurs working to grow small businesses, create 21st-century jobs, drive innovation, and increase America’s global competitiveness every day. And are recognizing the changing face of America, the SBA’s National Small Business Week Awards honors individuals and businesses that reflect our nation’s rich diversity.

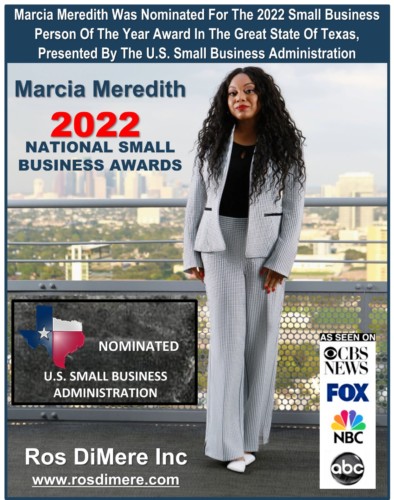

Marcia Meredith, Wealth Asset Manager of her company Ros DiMere Inc., Louisiana native, and Texas-grown have been in the SBA space since the beginning of COVID-19, assisting her existing and new clients navigate and manage their processes to sustain and stabilize their foundations during this pandemic in the government, public and private sector to date. As a first financial responder and advocate, this boutique wealth management firm, Ros DiMere Inc – Marcia established in year 2014, has assisted more than 300 companies nationwide since COVID-19, including those that were declined to being overturned, including those that have been experiencing inequality from business name profiling.

Meredith was recently featured in Business Innovators Magazine, “3 Reasons Why the SBA Turned Down Disaster Loans and How Marcia Meredith Got Them Overturn”. https://businessinnovatorsmagazine.com/3-reasons-why-the-small-business-administration-sba-turned-down-disaster-loans-how-marcia-meredith-of-ros-dimere-inc-got-them-overturn.

In addition, Marcia has gotten global recognition for her work with small business owners to receive the maximum amount of money that they were legally entitled from the Paycheck Protection Program. https://worldwidebusinesstrendsetter.com/how-to-choose-the-right-ppp-lender.

Recently Marcia’s article In Small Business Trendsetters focused on “Women In Wealth Management, Marcia Meredith Shares “How to Get A Seat At The Table.” https://smallbusinesstrendsetters.com/women-in-wealth-management-marcia-meredith-shares-how-to-get-a-seat-at-the-table.

Marcia’s business was bustling full swing ahead – transactions nearing its close after many, many months of deliberation, tabletop negotiations, plans for diversifying, hundred-million-dollar credit lines approved and executed showing full balance for verification; finally, dawn seemed to be appearing after the storms, yet a deadly global Tsunami was enroute unwarned nor foretold to wreak havoc throughout the earth. COVID 19 halted everything.

At the beginning stage of the declared pandemic, Marcia was 100% wealth management. Small business bidding was so 12 years ago. High net worth was the norm. Suddenly, during the middle of a few high-stake transactions, those high-net-worth clients disappeared. After weeks of silence during the last weeks of March 2020, Marcia thought she would take advantage of the SBA new relief program while including a few key persons she knew could use the help with their entities. Within 48 hours, consulting increased from those few key persons to nearly 20 plus businesses a day starting immediately upon early morning rise and alertness from a ringing phone line that once was private overflowing into the following day having to forcefully shut it down.

As the days went by, Marcia streamlined her process throughout her consultations. Marcia got savvy at setting policy and order on how to accommodate effectively that would yield a win/win for all involved. At the conclusion of the first month, April 2020, Marcia had serviced 120 new clients, not including the disqualified applicants who were serviced to some degree for a revisit in the future. Although per se, Marcia was not in the bank at her old desk of parent company HSBC processing applications and closing loans, the familiarity of intake, underwriting returned like riding a bike pulling on old SOP, techniques, making phone calls back-office SBA to ensure lending and compliance, for the new order that has been set center staged was in alignment to their processes.

Processing as many applications as Marcia did, she could ramble the data sight-unseen based on dates: application identifier, status, the systematic breakdowns, and so forth that were taking place. This information provided all her clients the edge. All clients were given the same first-class service her high-net-worth clients had been experiencing for many years. Not one client had to call SBA customer service to get nowhere fast and wait for hours on end in some crazy queue of 700 people. Marcia maintained a level of communication with all clients via mass email and group text messages of UpToDate information by the minute it was released, which typically Marcia was able to ascertain before it hit the press.

Aside from the origination of applications, nearly 33% of the new client base continue to retain many of the services Marcia provides through her company Ros DiMere Inc. which she has performed relocation and expansion, financial planning, cash flow analysis, underwriting term sheets, sale and purchase agreements, absolute financial advocacy for biasness of name profiling, troubleshooting, etc. The list goes on and on… some of Marcia’s clients refer to her as their financial mother; they do not make a new move unless they speak with her first.

Marcia stated, “I realized some of these clients are trophy clients; they have all the attributes that I could hope for thus assisting them get to the next level financially, especially with what I know how to do, so I implemented a client retention program that would absolutely take my chosen clients to a million-dollar status. Creating a new division in my wealth management portfolio for these businesses to grow and go into generational wealth, they jumped at the opportunity doubtless. And I agree they all have become students as I find myself spending time teaching the hierarchy of wealth literacy, not just financial literacy, but wealth. Now, I have re-evaluated, adapted, and adjusted to what I believe is part of purpose while gaining priceless knowledge pre-Covid and the how-to I can act as a midwife to a deserving few while they are giving birth to their brainchild. Last night, Showtime premiered Billions Season 6 Episode 1, Michael Prince implemented the exact method I utilize, let the potential clients prove their worth, deserve our help, it’s the basic 3 c’s in lending – collateral, capacity, and character. And of the three which means the most, character. He didn’t clear Axe Capital books for collateral and capacity, they were all billionaires, he cleared the portfolio for character, Bravo! First time I have ever applauded watching television. His speech was amazing!! Although my path has been slightly modified, I am ok with it, we adapt.”

This trend of SBA applicant qualification and client retention has continued to this day, bringing her to this amazing recognition nearly 24 months later. Many nominations were submitted to the SBA to nominate Marcia. However, the SBA notified Marcia before the nomination deadline to stop her network from campaigning for this honor. It was understood that many nominations were submitted for her liking. And while this chapter is nearing its close, Marcia has prepared – a few projects are underway as she is also ready to dive full swing ahead.

For more information, contact Ros DiMere Inc at 832-412-2140 or visit www.rosdimere.com.