Residents of Sugar Grove and nearby communities showed up in large numbers at a public hearing on Tuesday to make their views known about a proposed TIF district that would help bring a 760-acre mixed-use development to the village.

The proposed development is officially called The Grove but is more commonly referred to as the Crown development by those opposed, in reference to the project’s developer, Crown Community Development. Crown, through a subsidiary, owns the site of the proposed development and 23-year TIF district, which is located at the intersection of Interstate 88 and Route 47.

Early site plans for The Grove posted on the proposed development’s website show nearly 400 acres of residential development, over 120 acres of commercial development and around 240 acres for a business park. The website also says the development could hold as many as 1,500 residential units in a combination of single-family, townhouse, duplex and multi-family homes.

The public hearing on Tuesday took place during a Sugar Grove Village Board meeting held at Waubonsee Community College, where members of the public filled the Academic and Professional Center’s 10,000-square-foot Event Room. Nearly every seat was full, and many had to stand against the walls to fit into the room.

Over 40 people spoke during a nearly two-hour public comment period dedicated to the proposed TIF district, and around 20 people spoke during an additional public comment time later in the meeting. No decisions were made at the meeting.

During the public comment periods, residents voiced concerns about the area’s eligibility for a TIF district under state law and the impact a TIF district would have on nearby taxing bodies, such as school and fire districts.

Tax increment financing, or TIF, districts are allowed under state law to encourage the development of areas where development would otherwise not be financially viable.

When growth takes place in a TIF district, the extra taxes that come from that growth are placed into a special fund instead of being distributed among all taxing bodies during the district’s duration. The money in that special fund can then be used by a local government to pay costs associated with the development within the TIF district, such as creating or improving public infrastructure.

Consultants hired by the village said at Tuesday’s meeting that the village would not be taking on any financial risk if it creates the TIF district.

The idea, the consultants said, is that Crown will itself pay for improvements to the site, such as site preparation work and new infrastructure. If those improvements cause the area to develop, the taxes gained from that additional development would go back to Crown to pay back certain parts of its initial investment in improving the site, up to a maximum of $350 million across the TIF district’s 23-year duration, according to the consultants.

Geoffrey Dickinson, a partner at the economic development consulting firm SB Friedman, said The Grove project is not economically feasible without the TIF district. However, if the project does not bring the planned development, the village will not need to pay Crown back for its investments, he said.

Residents opposed to the project argued during public comment that, if the project is successful, it will place a burden on the taxing bodies which will need to provide services to the residents and businesses within the project without getting the additional tax revenue generated by the development at the site.

Some said this would raise taxes on existing residents as the taxing bodies look for ways to fund needed services due to the new development.

Blackberry Township Highway Commissioner Rodney Feece and Blackberry Township Supervisor Esther Steel spoke at the meeting against the proposed TIF district, echoing residents’ concerns about funding additional services created by the new development.

“The Blackberry Township Board opposes, respectfully, the TIF proposed by Sugar Grove,” Steel said. “We’ve done extensive analysis and are very considerate of what your goals are, but we believe this TIF will have an extensive negative impact to the economic well-being of Blackberry Township and the Blackberry Township taxpayers.”

Both Feece and Steel also submitted letters to the village opposing the TIF district.

The Illinois TIF law allows money to be paid from the TIF district’s funds to school districts for school age children moving into housing created because of the TIF district, according to Kathleen Field Orr, the village’s legal consultant on TIF districts. She said this was designed to help ease the burden on local school districts which may have to take on additional students without additional tax revenue.

Residents argued that this still puts a burden on the school districts since they would not be getting all of the tax revenue they would otherwise receive if the TIF district was not in place. Village officials said that, without the TIF, the schools would not get additional funding anyway because the property would not be developed.

Many who attended the meeting wore shirts that said “NO TIF — Taxes are bleeding us dry” on one side and “Your Taxes, My Treasure” on the other, referencing the higher taxes they believe residents might need to pay if the TIF district is approved and a sentiment among many public speakers that Crown is trying to use tax dollars to boost their own profits.

Residents questioned Dickinson’s findings that the development is not financially viable without the TIF district, saying that Crown has enough money to build the development without the village’s help. Others questioned why the village and its taxpayers should help Crown make a return on its investment in the land.

State law has very specific requirements for when and where a TIF district is allowed to be created, and residents who spoke at Tuesday’s meeting also argued that the proposed site does not meet those requirements.

The residents’ main concern was that Dickinson’s report categorized the project site as “blighted land,” a designation required for TIF district creation.

Some took issue with the main reason for the “blighted” designation, which according to the SB Friedman report is that stormwater runoff from the land contributes to flooding in the Blackberry Creek watershed.

Many residents said the report and an accompanying report from engineering firm EEI did not provide any data to back up their claims of runoff contributing to flooding. Others said that any elevated land contributes to flooding downstream, so that should not be an indicator of “blighted land.”

According to Dickinson, the law does not specify to what extent a site must contribute to downstream flooding before it can qualify as blighted, only that it does contribute to that flooding.

Others cited a clause in state TIF law that prevents land that has recently been commercially farmed from being eligible for a TIF district. Dickinson said that because the land is being subdivided, it would not count as being commercially farmed under the law.

Members of the public opposed to the TIF district also said the proposed district does not meet the law’s intention, which they said was to redevelop urban areas that have been neglected.

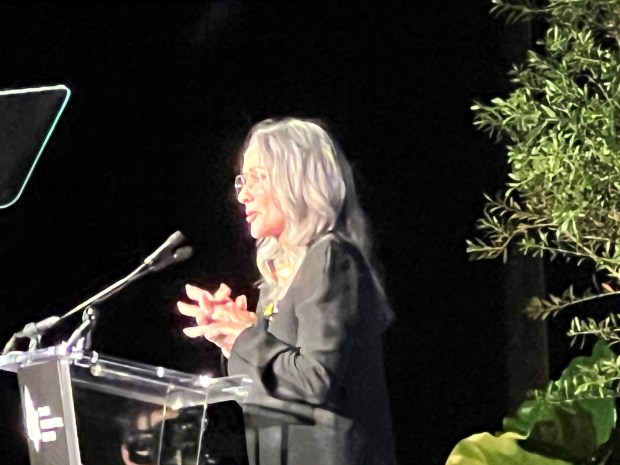

“Nothing about this potential TIF district, which is comprised of farmland and woodlands, jeopardizes the health, safety, morals or welfare of the public,” said Carolyn Anderson, who lives near the proposed development and is a longtime advocate against the project.

“There is no blight that needs to be eradicated,” she said. “This land contributes to clean air and water for everyone around it. It is a vulnerable resource to the community, not blight.”

While the state TIF law may have been originally designed to focus on urban redevelopment, it has been used across the state for other uses, Orr said.

Sugar Grove Trustee Heidi Lendi agreed with public commenters, saying later in the meeting during a board discussion that she does not feel the land meets the criteria for “blight” nor does it meet the intent of state TIF law, and that the categorization by SB Friedman is a “loophole.”

During a break in the meeting, Anderson told members of the media that her organization, Thoughtful Progress For the I-88/Route 47 Corridor, would be challenging the village in court if it approves the TIF district.

Last month, a board made up of representatives of all the impacted taxing bodies was tasked with discussing the proposed TIF district and making a recommendation to the Sugar Grove Village Board. However, that meeting ended with no recommendation being made as most of the representatives voted neither for nor against the proposal.

The Sugar Grove Village Board is set to consider a vote on the proposed TIF district on Aug. 20, according to a presentation given by Dickinson.

However, before a TIF district can be considered, the land must be annexed into the village and zoned, something that Sugar Grove Village President Jennifer Konen said should happen within the next 90 days.

rsmith@chicagotribune.com