Robyn Riedlinger is bringing her signature program, “Your Signature Talk”, to Las Vegas on September 26, 2024, as part of The Power of Voice 2024 Live Event, where thought leaders and entrepreneurs will gather to elevate their public speaking and business impact.

Category: News Room

“Ditch Command & Control Leadership: Transform Your Leaders from Boss to Coach” Celebrates Bestseller Success

Alissa DeWitt’s Groundbreaking Book Revolutionizes Modern Leadership Practices with Strategic and Actionable Insights

Chris Patterson Retirement Income Strategist, Interviewed on the Influential Entrepreneurs Podcast Discussing Tax Risk

Chris Patterson discusses tips and strategies for tax planning Listen to the interview on the Business Innovators Radio Network: Interview With Chris Patterson, Retirement Income Strategist Discussing Tax Risk – Business Innovators Radio Network Strategic tax planning is a crucial aspect of retirement planning that can help individuals mitigate taxes and secure their financial future. Chris Patterson discusses the importance of understanding and managing tax risk is highlighted as a key component of retirement planning. Mike Saunders and Chris Patterson, a financial advisor discuss the likelihood of tax rates increasing…

Paul Castner, President of C & K Healthcare Advisors, Interviewed on The Influential Entrepreneurs Podcast Discussing Retirement Planning

Paul Castner discusses maximizing your retirement savings Listen to the interview on the Business Innovators Radio Network: Interview with Paul Castner President of C & K Healthcare Advisors Discussing Retirement Planning – Business Innovators Radio Network Starting retirement planning early in life is crucial to maximize growth potential and ensure financial stability in retirement. As Paul Castner shared, individuals in their twenties and thirties have the best opportunity to be aggressive with their investments. By investing heavily in products tied to the market with a higher risk tolerance during this…

Bill Mcdowell, President of The McDowell Agency, Interviewed on The Influential Entrepreneurs Podcast, Discussing Roth Conversions

Bill Mcdowell discusses Roth conversion Listen to the interview on the Business Innovators Radio Network: Interview with Bill McDowell, President of The McDowell Agency Discussing Roth Conversions – Business Innovators Radio Network Mike Saunders and Bill McDowell discuss Roth conversions. Bill explains that Roth conversions are not a way to avoid taxes but rather a way to have control over when and how you pay them. By doing a Roth conversion, people can determine the exact dollar amount people will pay in taxes. This strategy allows people to plan for…

Jennifer Surmacz Founder of Posterity Legal, Interviewed on the Influential Entrepreneurs Podcast Discussing Relationship Generational Wealth

Jennifer Surmacz discusses securing legacy: the importance of generational wealth Listen to the interview on the Business Innovators Radio Network: Interview with Jennifer Surmacz Founder of Posterity Legal Discussing Relationship Generational Wealth – Business Innovators Radio Network Generational wealth extends beyond mere wealth accumulation in one’s lifetime. As discussed in the podcast episode, it involves working diligently not only for oneself but also for future generations, such as children and grandchildren. The overarching goal of generational wealth is to secure a better life for the next generations, setting them up…

James Lavorgna Outlines Navigating the Six Key Risks of Retirement

Retirement is a dream that many people have spent years preparing for, a time when they finally get to enjoy the fruits of their labor. The idea of leisurely days, free from the daily grind, is enticing. Yet, while retirement brings freedom and relaxation, it also introduces new challenges—some of which, if left unaddressed, could significantly impact financial security. With a little planning, this can be achieved. This article explores the six major risks retirees face and strategies to mitigate them, ensuring their golden years are as bright as imagined.…

Maurice Bailey, President of Wealthy Way Financial, Interviewed on the influential Entrepreneur Podcast, Discussing How Taxes Impact Retirement

Maurice Bailey discusses how taxes impact retirement Listen to the interview on the Business Innovators Radio Network: https://businessinnovatorsradio.com/interview-with-maurice-bailey-president-of-wealthy-way-financial-discussing-how-taxes-impact-retirement/ Maurice Bailey, the president of Wealthy Way Financial. He delved into the critical topic of how taxes impact retirement, a subject that often gets overlooked but is essential for effective retirement planning. Maurice began by highlighting the inevitability of rising taxes and the importance of preparing for this reality. He pointed out that most people assume they will be in a lower tax bracket during retirement, but this is often not the…

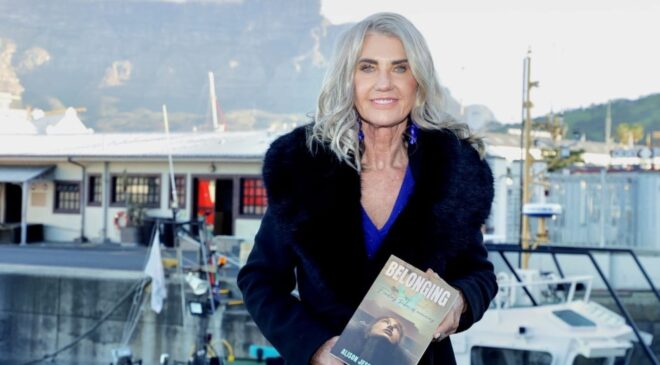

Anti-apartheid activist holds book launch in South Africa for personal memoir

An anti-apartheid activist has published a deeply personal memoir of her journey of growth and self-discovery. Alison Weihe’s debut book – Belonging: Finding Tribes of Meaning – tells the inspiring story of her life and how she made the journey from a child who felt invisible during her upbringing in apartheid-era South Africa to being a political activist and eventually an award-winning entrepreneur. The book was launched at a high-profile event at Exclusive Books in Victoria Wharf Cape Town on August 29, which was live-streamed on YouTube. During her career, Alison worked…

Chris Patterson Retirement Income Strategist, Interviewed on the Influential Entrepreneurs Podcast Discussing Sequence of Returns Risk

Chris Patterson discusses navigating the sequence of returns risk in retirement Listen to the interview on the Business Innovators Radio Network: https://businessinnovatorsradio.com/interview-with-chris-patterson-retirement-income-strategist-discussing-sequence-of-returns-risk/ Understanding the Impact of Sequence of Returns Risk on Retirement Income Chris Patterson, a retirement income strategist, the discussion shed light on the significant impact of sequence of returns risk on retirement income. The sequence of returns risk refers to the order in which investment returns occur, especially when retirees withdraw money from their portfolio during market downturns. As highlighted in the episode, experiencing negative returns in the…