Even as Sam Bankman-Fried faces decades in prison at his sentencing hearing later this month, the cryptocurrency market he promoted is staging a historic comeback.

Since October, when a federal jury convicted Bankman-Fried of conducting a massive fraud, the price of bitcoin has more than doubled. The world’s leading cryptocurrency could shoot even higher next month ahead of a scheduled market event called “halving” that will reduce by half the supply of new bitcoins being produced.

Bitcoin prices have soared so high that Bankman-Fried’s old firm, FTX, which lost billions of dollars in customer funds, could ultimately pay back customers and creditors in full, based on the increased value of its investment holdings. That prospect is certain to be part of Bankman-Fried’s plea for leniency on March 28 when he faces a federal judge who could impose a sentence of barely six years or less, as Bankman-Fried has requested, or the 40 to 50 years that the feds say he deserves.

More broadly, the bitcoin boom highlights the growth of retail participation in the markets. A new generation is being drawn into speculating on stocks, options and alternatives like crypto, which are digital files created as artificial currencies and traded on electronic platforms worldwide. The boost in activity stems from a combination of temptingly rising prices, new smaller-scale products and technology that makes accessing the markets as simple as making a phone call.

This page has pushed for stronger rules and greater transparency in the crypto market, which we consider full of potential as well as peril. Established exchanges and trading firms are just beginning to bring order to what was a free-for-all. If cryptocurrencies were a crying baby at this point last year, they have developed into a willful toddler that’s finally getting some adult supervision.

A welcome milestone occurred in January when cryptocurrencies became available as exchange-traded funds. ETFs are common investments these days and subject to sensible regulations. So even though the underlying crypto is still a wild card, it’s a blessing to see responsible “big kids” like Chicago’s CME Group and Cboe Global Markets playing in the same sandbox.

At the recent Futures Industry Association conference in Boca Raton, Florida, established players pleaded for clearer rules governing upstart markets like crypto. It’s no surprise to hear Rostin Behnam, chair of the Commodity Futures Trading Commission, say he needs more authority from Congress to expand his agency’s toolkit. Appearing at the same event, however, free-market advocate Ken Griffin of hedge fund giant Citadel said he also sees room for improvement: “When you have regulatory clarity, you’ll bring the big players into the space.”

Meanwhile, Securities and Exchange Commission Chair Gary Gensler is forging ahead without additional authorization, bringing dozens of enforcement actions that equate crypto and other digital assets with securities like stocks. Congress, frustratingly, continues to dither, despite what appears to be bipartisan support for updating the relevant laws. Those updates are way overdue.

Even as Congress fails to act, youthful investors continue to pull out their smartphones and jump into the fray. If the past is any guide, these newbies could lose big in the end. When markets go up and up, risks tend to multiply and the same people who think they’re making easy money trading Nvidia options or bitcoin ETFs can get a rude surprise if prices suddenly tumble.

Behnam’s CFTC just published a report that deserves credit for stating a blunt fact about inexperienced amateurs who dare to trade in venues dominated by pros: “In general,” the report says, in a reference to regulated futures markets, “we find that retail traders lose money.” The CFTC report goes on to note how getting burned can turn off a generation of amateur traders.

Representatives of Cboe, which has seen retail trading of its options contracts on more conventional investments surge, say they’re confident sufficient safeguards exist to protect investors. The real test will come if — when? — the market heads south in a hurry.

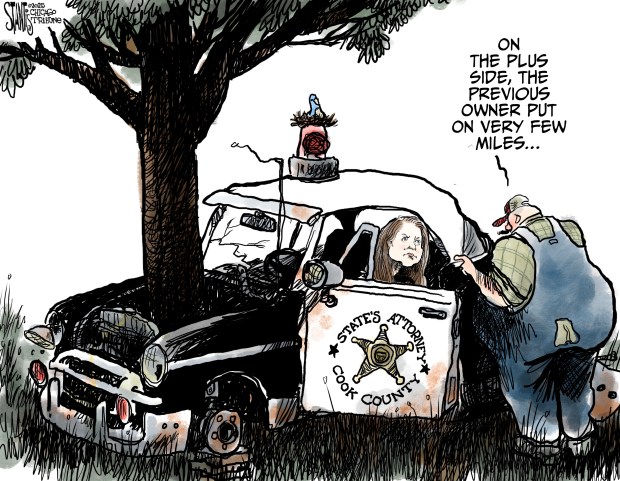

The Bankman-Fried sentencing will provide a reminder of just how wrong things can go when regulations fall behind reality in the marketplace. His FTX collapsed in a matter of days at the end of 2022. Investigators found billions of dollars in customer funds were missing, and a federal jury swiftly convicted Bankman-Fried of seven felonies.

The crypto market’s rebound is good news for FTX victims, but no one should think they weren’t victimized just because the market rebounded.

As Judge Lewis Kaplan prepared for Bankman-Fried’s sentencing, he received a letter from Indiana resident Stephen Salmen, who identified himself as a former Cboe trader. Salmen wrote that he had never written to a judge previously but felt compelled when he heard the argument for leniency based on FTX account holders eventually being repaid in full.

When Bankman-Fried’s company collapsed, no one knew crypto prices would soar again so soon, and many victims had to sell assets at a loss to meet their obligations, Salmen wrote. “They were harmed and will never be made whole.”

Salmen got it exactly right, and we hope Kaplan gives Bankman-Fried a sentence that reflects the outrageous facts of the FTX case. That would provide yet another public warning that anyone stepping into the financial markets needs to beware: Prices can go down much faster than they go up, regulation is lagging and investors should never put a penny more at risk than they can afford to lose.

Submit a letter, of no more than 400 words, to the editor here or email letters@chicagotribune.com.