Mayor Brandon Johnson’s planned $830 million bond to pay for a variety of capital projects is facing pushback from aldermen and others for its backloaded payment schedule and fears about the city’s long term debt load.

The total cost to repay the bond, according to initial estimates, is about $2 billion. But the city would only pay interest for the first 18 years. Principal payments would not start until 2045, a cost that would grow from $27 million to about $129 million by the debt’s due date.

That would leave 2050 taxpayers on the line for much of today’s road, bridge and street lighting improvement costs.

The City Council is set to vote Wednesday on Johnson’s borrowing plan.

Some members of the council and outside critics like state comptroller Susana Mendoza argue in light of recent credit downgrades, aldermen should shrink the planned borrowing or restructure the payment plan to spread out the taxpayer load more responsibly.

“You typically want to see level (or somewhat level) debt service payments and quicker debt retirement,” Lisa Washburn, managing director at Municipal Market Analytics, an independent research and consulting group on public finance, said in an email. The city’s plan is likely a result of current budget pressures and problems raising new money or cutting spending, she said. “This is a structure that I don’t think will be viewed favorably from a credit perspective.”

Johnson’s finance team counters further downgrades are unlikely due to this plan, and that their payment structure — when combined with other big debts coming due — does smooth out repayment costs for taxpayers overall. Paying principal earlier would mean the city would have to cough up extra revenue, something aldermen made clear they didn’t want to do during the last budget.

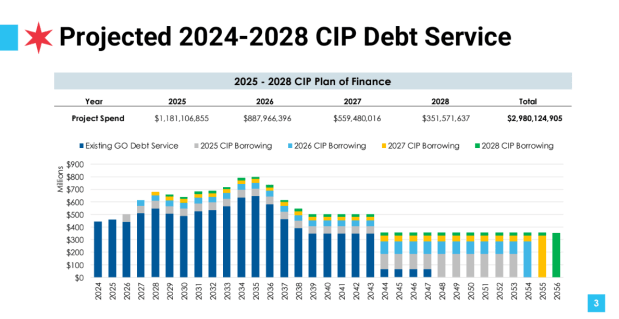

Other general obligation debt service built up from past borrowing will grow from about $450 million this year to a peak of more than $600 million by the mid-2030s, making it difficult to pay off that principal early, city finance officials told the Tribune Tuesday.

Not only is this planned borrowing “a relatively typical structure,” Chief Financial Officer Jill Jaworski said, ratings agencies are aware of the city’s long term debt obligations. This plan responsibly “keeps the total aggregate debt service relatively level and within a manageable part of the city budget.”

Moreover, “the cost for us, if we don’t do this bond issue and other (capital) bond issues would be much higher — when you defer capital investment, the costs grow. Keeping on top of the need is important for affordability,” Jaworski said.

Ald. Bill Conway, 34th, conceded “a lot of terrible decisions were made before we came in office,” building up long term debts, “which is why I don’t lay this entirely at the feet of the mayor.”

“But because those terrible decisions were made, that’s exactly the reason why we need to be judicious and making sure we’re spending and authorizing just the dollars we need now and not a blank check that we give out that they’re going to be paying off in 30 years,” Conway said.

“I’m 46 years old and a lot of the actuaries are going to tell you I’ll be taking a dirt nap by then, which shows how I’m trying to speak up on (future taxpayers’) behalf while I still can,” Conway said.

Finance officials said of the $830 million in planned borrowing, about $108 million would go to “menu” projects decided by each alderman and supplemental work from the city’s Department of Transportation; another $99 million would replace or repair bridges; $157.5 million would go toward new streetscapes and safety improvements at up to 150 intersections where crashes are most common; $74 million would update city buildings, including firehouses and fire damaged buildings; and $65 million would replace city cars, install new speed cameras, and provide new gear to firefighters.

Another $100 million would help replace lead service lines and $102 million would resurface residential and arterial streets and create 50 “green” alleys to help alleviate flooding.

Joe Ferguson, head of the fiscal watchdog group the Civic Federation, said he also supports borrowing for capital projects, even in a budget crunch like the city is currently facing. Without it, “it costs more later and your city starts to look like and function like the city everybody fears it is becoming. That feeds on itself.”

But given the structure of the payback schedule, Ferguson said the city “might as well carry a giant placard that says ‘We’re kicking the can down the road before we even get on the road.’”

“This idea of no payments of principal for 20 years is really off the rails,” Ferguson said, especially in light of recent credit downgrades from ratings agencies S&P and Kroll. He expressed similar worries about even more backloaded payoff schedules for its 2026, 2027, and 2028 capital borrowing laid out in briefing materials.

The city’s finance team argued last week that ratings agency downgrades were driven by the council’s rejection of the property tax increase and the continued use of one-time measures to balance the overall budget. Borrowing to support capital improvements was not on the list of factors the ratings agencies said would trigger further downgrades, Jaworski told Conway during a committee hearing last week; Borrowing to fill budget gaps, drawing down on reserves, or shorting pension payments were.

“I don’t think that Joe Ferguson has looked at our debt, looked at any of our past practices,” Jaworski told the Tribune Tuesday. “I don’t think he’s examined what is typical for large entities that are issuing large amounts of capital debt over extended periods of time. It is a responsible plan.”

“He’s also the same person that said we shouldn’t make our supplemental pension payment, even though that’s going to save us a couple billion dollars in the long term. So he thinks we should kick that can down the road,” she continued. “I think that he looks for a headline, and this is an easy one to make. But if he thinks that we should amortize it more quickly, I’d like him to show the tax increases that would go along with that that would be satisfactory to City Council and the residents.”

Asked about the debt service schedule Monday, Budget Chair Jason Ervin, 28th, also defended the plan as “fairly standard.”

“This is an annual appropriation for debt service for our infrastructure. There’s nothing new here, there’s nothing different here,” he said.

Ervin, Johnson’s Budget Committee chair and floor leader, questioned where the skepticism surrounding the plan came from and said similar bond initiatives under Mayors Lori Lightfoot and Rahm Emanuel didn’t face such scrutiny.

“It’s interesting, some of these same folks that voted on these things, now have found some new religion.”