With Indiana’s property tax bill signed into law, Northwest Indiana counties and municipalities are preparing to lose out on millions of dollars for essential services.

Accelerate Indiana Municipalities reviewed Senate Enrolled Act 1, the property tax relief bill that was signed into law April 15, and found that it phases up the homestead deduction to two-thirds of homestead assessed value and provides a new tax credit up to $300 or 10% of a homeowner’s tax bill, whichever is less.

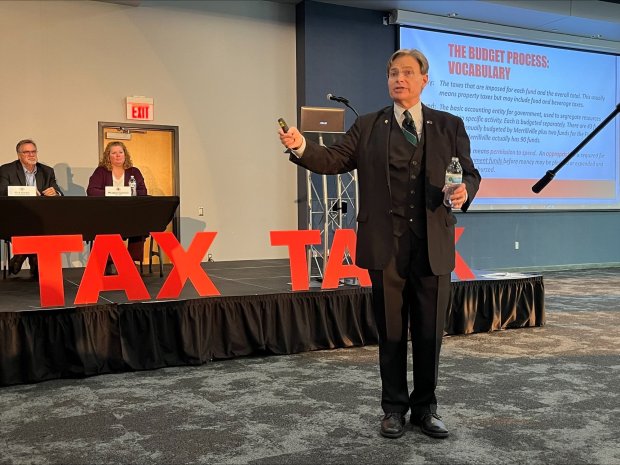

While Senate Enrolled Act 1 was a massive bill, the homestead deduction and tax credit are “the bulk” of the fiscal impact on local governments as it will limit property tax revenue growth in the coming years, especially in communities that are heavily residential, said AIM CEO Matt Greller.

The resulting decrease in property tax revenue will likely result in local governments increasing income tax to fund local services, Greller said.

Property taxes are a reliable revenue source, Greller said, because it weathers economic downturns. Property tax revenue is also predictable, so local governments can gauge within a percentage point how much money they will receive and can plan expenditures, he said.

Income tax is more volatile and susceptible to the ups and downs within the economy, Greller said. It’s likely local governments won’t have the ability to issue bonds, or debt, because income tax isn’t a stable backer, he said.

“We’re going to be funding basic government services on income tax, which I think is less optimal than the system of fully funding it with property tax,” Greller said. “It’s less predictable, less reliable with the income tax.”

Under the law, counties can raise the local income tax rate cap from 2.5% to 2.9% beginning in 2027. Of that, 1.2% is allocated for county services, 1.2% is allocated for general revenue, 0.4% is allocated for fire protection and EMS services, and 0.2% is allocated for nonmunicipal taxing units.

Senate Enrolled Act 1 eliminates the current property tax relief credit, which uses local income tax to fund property tax deductions for residential homesteads, Greller said.

The fiscal note for Senate Enrolled Act 1 indicates that Lake County will lose approximately $32.9 million in 2026, $37.2 million in 2027, and $165 million in 2028. Porter County will lose approximately $13.7 million in 2026, $14.5 million in 2027, and $21.4 million in 2028.

As local governments are set to lose millions in revenue, Greller said it’s unclear how much of the income tax revenue will fill that void.

“Everybody is looking at that big picture impact number, which is obviously important, but we don’t have the other side of the story quite yet in terms of knowing how to replace it and what that will drive in terms of revenue,” Greller said. “Which is scary, because we’ve now put into law a major policy change without understanding the backside of how much the new revenue stream will produce.”

For business personal property tax, Senate Enrolled Act 1 increases the de minimis exemption, which is currently set at $80,000, to $1 million in 2025 and $2 million in 2026. Retroactively to Jan. 1, Senate Enrolled Act 1 exempts new business personal property from the 30% depreciation floor, Greller said.

Greller said the business personal property tax change will adversely affect Northwest Indiana, which is a heavily industrial area. Greller said it’s unclear to know the exact fiscal impact of the business personal property tax change on Northwest Indiana until it goes into effect.

“The complexity of this bill is overwhelming,” Greller said.

Shifting the business personal property tax from $80,000 to $2 million ultimately lowers the assessed value for businesses and offsets any savings when adjusting the homestead deduction to two-thirds of the assessed value for homeowners, said Lake County Finance Director Scott Schmal.

Had the legislature adjusted the assessed value for businesses, the legislative session could’ve ended with a more impactful property tax relief plan, Schmal said.

Lake County currently has a 1.5% local income tax, Schmal said, which the county has historically used to reduce property taxes under the property tax relief credit. With the elimination of the property tax relief credit in December 2027, Schmal said property taxes in Lake County could increase.

“In terms of what’s the county going to do financially to navigate all this, those strategies are being developed right now,” Schmal said. “We’re still trying to digest everything that’s in the bill, what you can and can’t do.”

Ryan Kubal, Porter County’s director of budget and finance, said the impact of the new law will overall slow the growth of all taxing units in the state. In Porter County, officials are discussing how to supplement the reduction in funds through the local income tax, wheel tax and cuts throughout the county, he said.

In Merrillville, the town will lose approximately $831,000 in 2026, approximately $957,000 in 2027, and approximately $1.3 million in 2028, said town manager Michael Griffin. Currently, Merrillville uses a “significant” amount of property tax revenue to pay for public safety.

Griffin said while he agrees with the notion of decreasing property taxes, the legislature approached its proposal hastily. Property taxes have been proven across the country to be a revenue source that can withstand economic ups and downs, helps cities and towns secure bonds and is a reliable revenue stream to fund police and fire departments, he said.

In Merrillville, 10% of the tax base is business personal property, Griffin said, so the shift will impact the town as well.

Merrillville officials will work to understand the new law better and look for places in the budget, Griffin said. But, what’s tricky is property tax revenue covers operational costs, he said.

“Right now, we’ve gotta contend with trying to keep the same level of services as they are,” Griffin said. “I don’t think that there is a city or town in the state of Indiana that will not find this impact complicating if not challenging.”

Senate Enrolled Act 1 could have unprecedented consequences for Gary, said one city councilman.

“The concern with Senate Enrolled Act 1 is not necessarily tax relief for homeowners,” said Councilman Darren Washington, D-at large. “The concern for Senate Bill 1 is that when you give the tax relief to homeowners, who bears the burden of funding government?”

As a result of Senate Enrolled Act 1, Washington is worried that Gary will have to implement a local income tax on top of the Lake County tax to fund its resources.

The majority of Gary’s tax followers come from homeowners, Washington said, and the city doesn’t have enough industry to make up for the property tax relief.

“The hope is that this will help spur development in the city of Gary,” Washington said.

He believes Senate Enrolled Act 1 will benefit residents in communities such as Fort Wayne, South Bend and Evansville.

Washington’s concerns for Senate Enrolled Act 1 are coupled with those about House Bill 1448, which requires Gary to pay more than $12 million to East Chicago and Michigan City after a state comptroller mistake that was supposed to address the financial burden following the move of Majestic Star casinos.

Money will be deducted from state comptroller funds and money appropriated by the Indiana General Assembly, according to bill documents, and money will be withheld for 10 years.

“We’ve got to begin to strategize,” Washington said.

Washington’s concerns about Senate Enrolled Act 1’s impact on Gary have impacted his actions on city council. At the legislative body’s April 15 meeting, Washington and four other council members voted to rezone the former Alfred Beckman Middle School property to allow for a new development.

The former middle school will be rezoned from R2 residential to a planned unit development, or PUD, and B3-1, which allows for shopping centers or large stores.

“We have over 8,000 properties that are unused, and this is one of the reasons why I supported and continue to support the Beckman school project,” Washington said. “We need businesses and industries on the tax rolls because of things like (Senate Enrolled Act 1).”

Other Gary council members — including Mary Brown, D-3rd, and Kenneth Whisenton, D-at large — have agreed with Washington and said developments are the best way to help the city.

Washington expects that Gary won’t immediately feel the effects of Senate Enrolled Act 1.

Hammond Mayor Tom McDermott said in a text to the Post-Tribune that Hammond won’t know the exact effects of Senate Enrolled Act 1 until the summer.

Council President Dave Woerpel, D-5th, previously related Senate Enrolled Act 1 to the potential Lake County Convention Center project.

The Hammond Common Council recently approved a resolution in opposition to the convention center project. Woerpel said it’s dangerous to build a convention center when the state hasn’t felt the effects of Senate Enrolled Act 1.

“How do you explain that in three to four years from now, that the state says we’re going to be $8 million short towards our city budget?” Woerpel previously said. “And the state says we can impose a city income tax.”

akukulka@post-trib.com

mwilkins@chicagotribune.com