For University of Illinois Chicago visiting senior research specialist T. Chedgzsey Smith-McKeever, creating a path to higher education became a road to debt.

Her San Diego beginnings led to stints at the University of California at Irvine and the University of Southern California, and ended with a Ph.D. from the University of Texas at Austin. But Smith-McKeever, who had been diagnosed with diabetes at age 13, had to juggle school debt with paying out of pocket for her preexisting condition.

In between her bachelor’s and master’s degrees, she defaulted on her student loans.

“I got out of undergrad owing around $15,000,” she said. Then Smith-McKeever became pregnant. “That was my great motivator. What killed me was getting my master’s degree because I’m paying for me to survive, for my daughter to survive. The tuition was outrageous. I went from owing $15,000 to $120,000.”

She remembers being in and out of homelessness even with a bachelor’s degree in psychology. “I knew I had to get more education,” she said, “otherwise there is no way I’m going to be able to take care of this child.”

Smith-McKeever got lucky when a friend offered her late mother’s home as a place for her to stay. Without having to pay rent, she saved enough money to get out of default to continue her education. Once she got her master’s degree, a job at the Los Angeles County Department of Children and Family Services adoption division allowed Smith-McKeever to be able to afford rent for a studio apartment and child care.

Although she was able to manage things, her student loan payments were $1,200 a month. It was a number that she didn’t even share with her spouse.

“It was killing me,” said the social work educator and researcher, who moved to Chicago in 2002.

She managed to get that number down to $560 per month by negotiating with her lender and demonstrating with her income tax returns that much of her income was consumed by medical expenses.

“It doesn’t matter if I’m paying $560 if I owe over $200,000,” the Evergreen Park resident said. “You’re not paying as much, but you’re seeing that interest accumulate. It’s terrifying because it’s just getting bigger and bigger.”

So she Googled “help with managing my student loan debt” and was pointed to the Chicago law firm of Rae Kaplan. Smith-McKeever had spent nearly 20 years working at public universities and struggling to get her loans forgiven. But after working with Kaplan for a few years, Smith-McKeever finally received a letter in the mail saying, “your debt of $274,000 is forgiven.”

“I have an autoimmune disease; I don’t have a strong immune system,” Smith-McKeever said. “Between the end of COVID and now, like a year ago, I lost my right leg. I’ve had setback after setback. However, I believe the weight that retiring that student loan debt took off me, the psychological emotional stress that it removed from me really helped me be able to get through this challenge of losing my leg.”

Kaplan Law Firm was solely working on bankruptcies until 2014, when Kaplan decided to focus on helping people with student loan debt.

“We still practice bankruptcy law, but our student loan practice has eclipsed what the bankruptcy practice ever was. There are so many more people who need answers on their student loans and don’t need a bankruptcy,” Kaplan said. “If you forgive $40,000 or $50,000, for a middle-class family, that’s life-changing.”

The Kaplan Law Firm helps individuals and families understand the educational loan process before and after they sign the loan papers. Kaplan and her team help determine the best course of action for limiting and eliminating student loan debt. In most cases, Kaplan said, the federal loan monies taken out will be eligible for a type of income-driven repayment plan provided by the United States Department of Education.

Kaplan analyzes each client’s loans, federal and private, and if they are private, Kaplan goes over best strategies to reduce payments and get maximum loan forgiveness.

“For private loans, we’re looking at whether or not the best options are refinancing because in many cases, the borrower will have taken out a high interest loan that really just needs to be refinanced and that will do a lot to lower their payments and reduce the amount that they pay back overall on that loan,” Kaplan said. “If those private loans are already in default, then we can negotiate a reduced balance settlement. Very often you can get the creditor to agree to a 50% settlement. That’s a big money saver.”

Whether it’s a parent curious about taking out Parent Plus Loans for their child, a high school student who has plans for their major and career, or a person who has been paying their student loan for 10 to 25 years, Kaplan said she can be of assistance.

She said the student loan process is confusing. Kaplan spoke of an attorney who owed six figures in student loans but got confused by the information and misinformation about student loan debt. So she came to Kaplan, who got her enrolled in the Saving on a Valuable Education, or SAVE, plan, an initiative of President Joe Biden’s administration that went into effect this year. It is an income-driven repayment plan that calculates a monthly payment based on income and family size. The attorney is now paying $180 per month under the repayment plan and Kaplan said the woman is going to wind up paying back about $25,000 of her loans and then the remaining balance will be forgiven.

“If you know what you’re doing when it comes to your student loans, you can save so much money, but the key is you have to know the system and understand how it was set up and how it works and how that applies to you and to your loans because it’s a very fact-specific situation,” Kaplan said. “There is a lot of information out there, but it’s still confusing because there are different types of loans and the law applies to them differently depending on your circumstances. Some people are going to have to pay back their loans in full. Those are usually high-income earners … but you might still be able to get some forgiveness of the interest that accrues. The interest is a killer, because it starts accruing as soon as the loans are disbursed to your school. Most people don’t know that and they’re shocked when they come out of school … and then they see the balance has doubled and tripled.”

Kaplan said having a servicer provide incorrect information can add to the frustration. She has been on the phone with servicers for hours on behalf of her clients and then the call drops; she’s also had servicers incorrectly calculate monthly payments.

“The servicers are not there to help you,” she said. “They’re just there to keep track of your payments and keep your loans out of default. So they very often will tell people, OK, you’re having trouble making payments, let’s put the loans into forbearance when that’s very often the wrong thing to do because interest is then accruing and capitalizing, so it’s increasing the balance. And during that time, maybe that person was eligible for a $10 monthly payment plan that would get them further on track for forgiveness.”

Despite a recent federal stay on the SAVE plan, Kaplan is a big proponent of the plan because most people will have their payments reduced by 50% just by enrolling, she said. The plan also has a 100% interest subsidy, which means any interest that accrues gets waived by the Department of Education. Before July, over 5,500 Illinoisans were identified for loan forgiveness with the SAVE plan, amounting to $43.8 million.

Even though there is litigation challenging whether the Biden administration had authority to create the plan under the Higher Education Act, Kaplan said she thinks SAVE will survive. But in the interim, there are other income-driven plans that are “very reasonable and based on a percentage of the borrower’s income … usually 10% to 20%,” Kaplan said.

Kaplan counsels borrowers before they take out loans so they don’t upend their financial futures. “For student loans, it requires careful planning and knowledge so that you pay what you’re supposed to pay, but again, not more than you’re supposed to pay. And there is tremendous relief available; you just have to know how to access it,” Kaplan said.

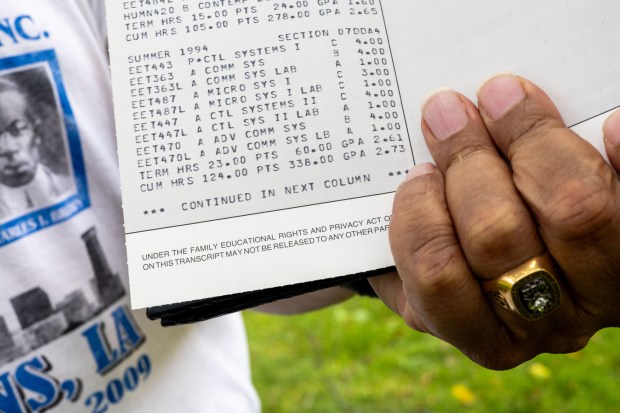

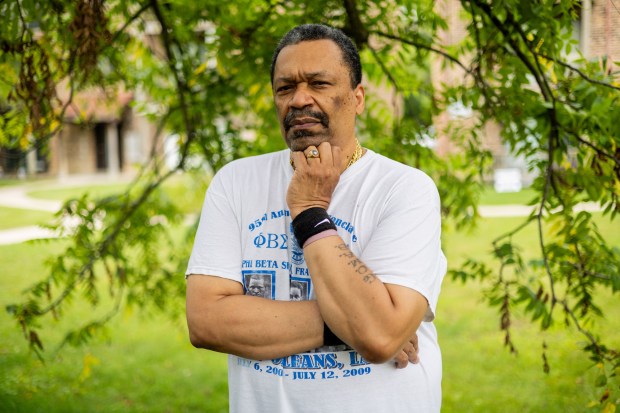

After a 45-year career in the shoe industry, Homewood resident Marc Atkins endured a deep vein thrombosis in his left leg in 2020. When the world was reopening after lockdown and the possibility of going back to his job at Nordstrom in women’s shoes was an option, he opted to take early retirement. But student loans in the amount of $232,195 loomed for the DeVry graduate. He, too, Googled student loan attorneys and found Rae Kaplan.

“That was the only thing on my credit report … two loans that came to about $165,000 or something like that collectively, but the interest is what shot it up,” said Atkins, 66. “Interest alone was soaking up any payments I was able to make. I knew there was no way I was gonna be able to take on (student loan payments) dealing with my monthly living expense. … I’m retired and on a fixed income; it was not feasible that I could deal with that included.”

Within months of touching base with Kaplan, Atkins had all of his student loans forgiven. “My stress level is pretty much zero. … I’m at peace … living life, being comfortable,” the 66-year-old said.

Since then, Atkins has referred former co-workers and residents in his building to Kaplan, whose fees start at $350 for a consultation. After that, the range depends on how much work is involved in the case, which can start at $1,500 and go up to $3,500. But Kaplan says she does many pro bono cases when a client isn’t in a position to pay.

Education used to be the great equalizer, said Smith-McKeever, whose daughter signed up for the SAVE Plan. “But the cost of education has gone so far out that it seems a trap,” Smith-McKeever said. “It’s crazy how expensive it’s gotten, but there’s an out, there’s a secret: It’s Public Service Loan Forgiveness and income-driven repayment plans.”

The educator has since told many students about Kaplan’s expertise. Her rationale: A cost of hundreds now is better than thousands of dollars down the road. Kaplan is trying to line up free seminars at area schools and institutions so more people are privy to the details of debt relief.

“Every Black, brown and Indigenous person needs to know not to let the cost of college be a barrier, because there’s a way out of the debt,” Smith-McKeever said. “Our lives are overwhelming. Having somebody to send you the paperwork, so you don’t get caught up, and you get out of (debt) and live your life in the process … that’s the drum that I’ve been beating.”

It’s also a drum that a number of other services have been beating for years. The Illinois Student Assistance Commission, the state’s college access and financial aid agency, offers free help with college planning and financial aid.

The Consumer Credit Counseling Service of Northern Illinois, a nonprofit credit counseling agency, has been helping with debt management for over 40 years. And the nonprofit Institute of Student Loan Advisors was started in 2018 by Betsy Mayotte, a former compliance officer at a nonprofit student loan organization, because she wanted an avenue for people who needed help with their student loans.

“I’ve researched the Higher Education Act and the history of student loans back to the ‘70s, and I can say unequivocally that I’ve never seen a period of time in student loans like this, sort of chaotic,” said Mayotte, who is based in Massachusetts. “It’s become really difficult to try to advise someone what to do because this is uncharted territory.”

Donna Rasmussen, executive director at Consumer Credit Counseling Service of Northern Illinois, said that when people think they’re getting in trouble with their student loans, they should contact their loan servicer to work out feasible options for repayment. She also recommends families seek out a counselor’s help at a nonprofit credit counseling agency when their child is in high school to start planning their higher education goals and how much in loans one needs.

“What we try and put in their head is that whatever you think you might be making your first year at your career out of college — that entire year of your income — that’s about the amount of student loan debt that we recommend people take,” Rasmussen said. “Don’t take more.”

She added that although occasionally there’s assistance for loan repayment or forgiveness, it’s not always an option. So if you’re taking on debt, you want to make sure that you have the capacity to pay it back. That’s why her firm helps people with budgeting plans to make sure they can do that.

Ana Moya, an ISAC professional development specialist, recommends not taking out the maximum amount of loans, even if they’re offered to you. Take only what you need, she said. And figure out how much you need by filling out the FAFSA, the application for federal, state and institutional aid, or if you are an eligible undocumented student, the Alternative Application for Illinois Financial Aid. The FAFSA is not just for loans, but also scholarships and grants. And check student loan forgiveness programs for certain professions prior to enrolling in higher education as it could affect your college planning.

“On our website, we have a ton of information,” Moya said. “If you go to any of our webinars, and you’re like ‘Would I qualify for this program?’ we can ask you a set of questions to see if you’re on the right track and what questions you should be asking the servicer, since we don’t have direct access to your loans.”

Smith-McKeever said she had planned to go into the Navy and have that pay for her education, but the diabetes diagnosis derailed that plan. While paying her student loans, her living expenses and health care expenses, she hasn’t been able to accumulate wealth, but she’s looking forward to breathing a bit easier without the suffocating debt.

Kaplan said that although the Biden administration has done a lot to make the student loan process easier, there’s still a long way to go in terms of educating borrowers. “I have a lot of clients who are doctors, lawyers, financial planners, and none of them have any idea how to approach student loans,” Kaplan said. “I like being able to help people and take that stressor off their shoulders.”