Valparaiso University officials came before the Valparaiso City Council Monday to explain their bid for the city to serve as a conduit for up to $117 million in general obligation bonds for some campus renovations and to refinance university debt.

What they got was a host of questions from the council on why the university sold cornerstone artwork from the Brauer Museum to fund freshman dorm renovations if they were undertaking a bond issue, whether the city would face any financial obligation, and how to explain the request to their constituents.

“We have a lot of publicity regarding some art sales,” said Mark Volpatti, the university’s senior vice president for finance and chief financial officer.

The university has sold or is concluding the sale of the three paintings, including one by Georgia O’Keeffe, and is moving forward with its freshman village, he said, adding the renovation work was being done without taking on debt and through “the proceeds from the artwork.”

University spokesperson Michael Fenton confirmed in an email to the Post-Tribune Tuesday that O’Keeffe’s “Rust Red Hills” and “The Silver Veil and the Golden Gate” by Childe Hassam have been sold.

Because the sale was conducted through a private broker, he did not have information on the identity of the buyers. The sale of Frederic E. Church’s “Mountain Landscape” is still in process, Fenton said, “and there is no further information at this time.”

Work on the freshman village, as Volpatti called it, includes air conditioning, furniture and other upgrades. The dorms, Brandt and Wehrenberg halls, are slated to have a gallery displaying lesser-known works of art from the Sloan Trust, which directly or indirectly provided the three paintings being sold off. The work is slated to begin this summer and conclude by fall 2026.

“People will say the No. 1 reason people don’t come to Valparaiso University is because of the housing,” Volpatti said. “All the other stuff is really good for us.”

As far as the bonds, Patrick Lyp, the city attorney, said the city can act as a conduit for the bond purchase and has done so for other non-profits, including a senior housing facility a few years ago.

“This is not necessarily debt issued by the city, where we’re responsible,” he said.

David Nie, an attorney with Ice Miller and the university’s bond counsel, reiterated that the bonds do not obligate the city financially. Under the Internal Revenue Service’s tax code, non-profits have to go through a government entity to secure general obligation bonds.

In this case, he said, the Valparaiso Economic Development Corp. can serve that role, which also is allowed under state statute.

“Their consideration is whether the project would be of benefit to the general welfare of the city and we think we meet that threshold,” Nie said.

The maximum for the bond issue is $117 million but Volpatti expects the amount to be closer to $55 million, with about $15 million for infrastructure upgrades on campus, including new roofs, information technology work, and other needs. The rest of the funds will be used to refinance existing debt.

The university’s goal, Volpatti said, is to have the bonds on hand by the end of June, which also is the end of the university’s fiscal year.

City council members had an assortment of questions about the sale of the artwork, the university’s junk bond status by Moody’s, and whether the university had a backup plan if the council voted against pitching in with the bond issue.

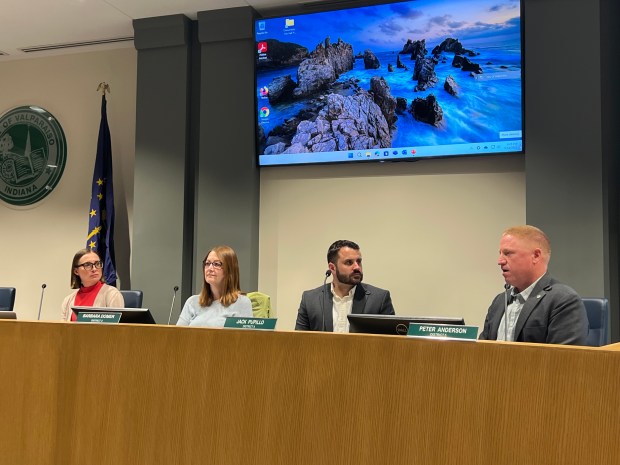

Councilwoman Barb Domer, D-3rd, asked Volpatti to confirm that the freshman dorm renovations weren’t included in the $117 million bond issue and that the entire cost of those renovations would come from selling the paintings, which he did.

The university expects the paintings to bring in around $12 million, which is what’s being invested in the dorm renovations, Volpatti said, adding the $117 million figure for the bond issue “is if we go all in and we don’t think that will happen.”

“What’s the Plan B? What happens if this body says no?” asked Councilman Peter Anderson, R-5th.

The university would have to figure out the funding, Volpatti said, and determine whether that’s done through philanthropy or selling core assets.

Nie, under questioning from Council President Ellen Kapitan, D-At-large, reiterated that the city would serve as a pass-through for the bonds.

“In no way does this ever reflect on the issuer that issued the bonds. In no way does this come back to the city,” Nie said, adding the bonds would not impact taxpayers.

Councilman Robert Cotton, D-2nd, like other city officials, said he supports the university but had questions about the university’s recent bond rating analysis from Moody’s.

“I just feel very responsible to understand as best as possible the recent change in the bond rating” and whether that’s from the university’s debt or its enrollment struggles, Cotton said.

Moody’s Investor Services, Inc. recently downgraded Valparaiso University two notches to a junk rating, which could raise the university’s borrowing costs.

In an April 30 report, Moody’s noted that “the highly competitive student market poses ongoing difficulties for enrollment management. Inability to boost net tuition revenue will further limit financial reserves and the university’s capacity to address operating deficits in the short term.”

The negative outlook, Moody’s said, “reflects the potential for continued enrollment challenges resulting in pressure to balance operations.”

The university is working to “right-size,” Nie said, and determine where it sees growth. At one time the university hoped to have more than 6,500 students but “that’s not happening,” he said. The university had 2,598 students at the start of the 2024-2025 academic year, according to its website.

The goal, Nie said, is for the university to break even for two years and generate revenue four years out. Still, Cotton wanted to know if the university would be “pressing against a debt limit” with the general obligation bonds.

Nie confirmed that the university has enough funding to support the bond payments, and added that the university will only be taking on an additional $15 million in debt for the infrastructure work since $32 million to $37 million will be used to restructure debt. This is the first time the university has asked the city to be a conduit for a bond issue.

“If this was an option, can I ask why it wasn’t used instead of selling the artwork?” asked Councilwoman Emilie Hunt, D-At-large.

The artwork was sold, Nie said, because university officials “felt like we had a very great asset but it wasn’t doing the most from an operational capability for the campus to run. It was just a decision the university made.”

Per the court order that allowed for modifying the trust that provided the funding for the paintings, Nie said, the funds have to be used for the dorm renovations. Any money left over also has to go toward university housing.

Domer said she was still trying to figure out the sequence of events and how she was going to explain that there was more than a year of legal controversy over selling the art because those funds were necessary for dorm renovations.

“That’s all happened and now there’s a request for a $117 million bond issue and when I think about the sequence of events, wouldn’t all of this have been known a year ago or even six months ago, on the heels of a court order saying it’s OK to sell those paintings to renovate the freshmen dorms?” she said.

The university chose to sell the paintings for the dorm renovations, Volpatti said, because “we thought that was the best return on the investment.” Selling the art, he added, was the best thing for the university and, in turn, the city because the renovated dorms would bring people here.

“From our position, this is a bit of a confusing thing, right?” Anderson said. “The city is doing something for the university, it’s this very innocent pass-through thing but it’s very difficult to explain that to the public.

“I would think you would do yourselves a service by letting us know exactly what the projects are going to be because that allows us to present that to our constituents.”

Nie said the university could share a memo about the details with Lyp. Additionally, Lyp said the university will have to present an economic benefit statement to the VEDC, including job retention, which is at least as important, if not more so, than new hires.

The university has about 600 employees, Volpatti said, with about 200 or 225 faculty members and the rest staff employees.

“For me, it’s really important that we have Valparaiso University. It’s a huge asset to our community,” Kapitan said.” I’m glad we’re able to have this conversation to show our support but at the same time, I’m understanding what our role is in this, and we’re successful when you’re successful.”

Mayor Jon Costas said he appreciated the conversation and understood that the city would look and feel a lot different without the university.

“Smaller, private institutions are challenged and you’ve got to make some difficult decisions to make sure you’re succeeding,” he said, adding the city would not be taking on any risk by serving as the conduit for the bond issue.

The council voted to carry the matter to its next meeting, scheduled for June 9, though it could schedule a special meeting before that to consider the proposal. In the meantime, the city’s plan commission will have to give the proposal a cursory glance, which officials expect to be routine since it doesn’t include anything involving city infrastructure.

The Valparaiso Economic Development Corp. will hold a public hearing about the bond issue at 2 p.m. May 28 in council chambers at city hall, the only public hearing on the proposal before it goes back to the city council for a final vote.

alavalley@chicagotribune.com